[ad_1]

U.S. inflation intimidates inventory market

We had been speculated to be getting into the time of the yr when inflation must be trending downward and inventory markets may get again to a “regular” state of gradual development or maybe marginal pullbacks.

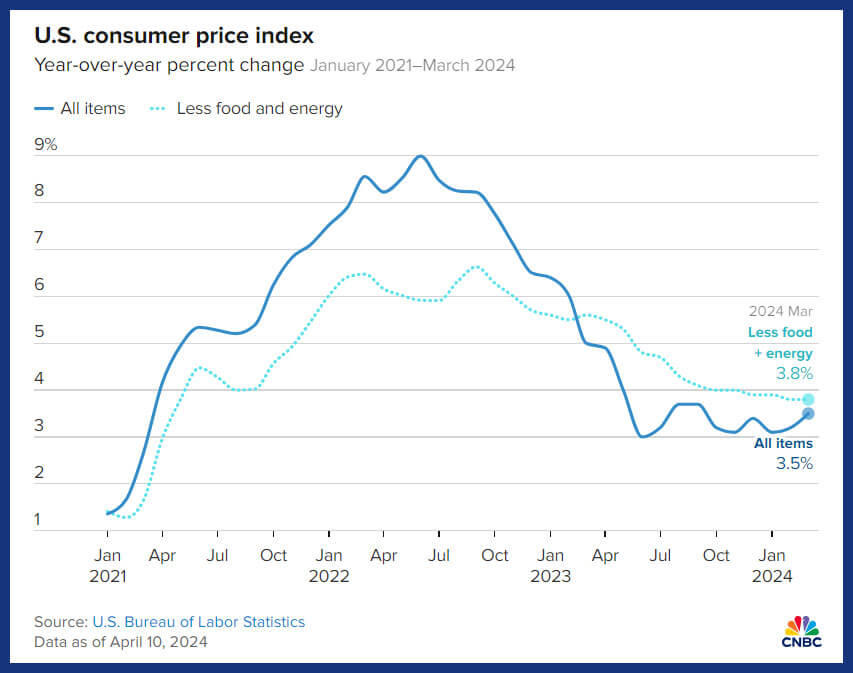

As a substitute, the U.S. inventory market has been on a comparatively quick climb, although excessive inflation ought to have begun to tug it down. One thing needed to give. And on Wednesday, the inventory market gave again about 1% of its positive aspects to this point this yr, because the U.S. Bureau of Labor Statistics reported that the U.S. shopper value index (CPI) jumped 3.5% in March 2024. Core CPI (excluding meals and vitality) was even greater at 3.8%.

Shelter and gasoline prices had been the principle culprits in driving the elevated CPI quantity, and had been liable for greater than half of the three.5% enhance. New and used vehicles had been vivid spots within the report, as that they had value declines, when in comparison with a yr in the past. Groceries prices had been largely unchanged, however costs had been up throughout just about all providers.

U.S. President Joe Biden stated, “Immediately’s report reveals inflation has fallen greater than 60% from its peak, however we have now extra to do to decrease prices for hardworking households. Costs are nonetheless too excessive for housing and groceries, whilst costs for key home items like milk and eggs are decrease than a yr in the past.”

In the meantime, the Financial institution of Canada (BoC) determined—as was broadly anticipated—to proceed to maintain rates of interest at 5% on April 10. BoC governor Tiff Macklem said {that a} June fee minimize was “throughout the realm of prospects,” however he wanted to see an additional decline in core inflation to make certain the latest downward inflation pattern was “not only a momentary dip.”

This newest inflation studying out of the U.S. led a number of market commentators to invest that summer season fee hikes could also be off the desk for our neighbours to the south. If the U.S. Fed continues to delay fee cuts, it’s going to place stress on the BoC to not minimize charges, too, as doing so will drive the worth of the Canadian greenback down, relative to the U.S. greenback.

Don’t miss my tackle the greatest investments for inflation hedging at MillionDollarJourney.com.

Have cash, will journey

Delta CEO Ed Bastian summarized the sturdy demand, saying: “Shoppers proceed to prioritize journey as a discretionary funding in themselves. […] We’re flying even greater degree of capability this summer season than final, and we count on our general pricing ranges are going to stay largely the identical.”

[ad_2]