[ad_1]

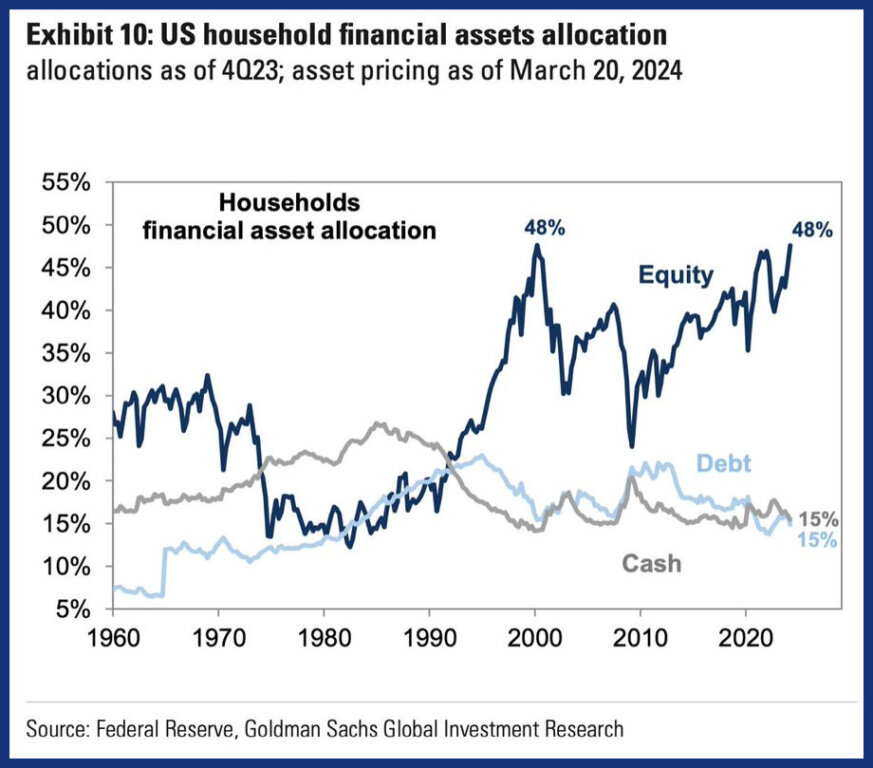

The excessive rates of interest over the previous few years have led to the explosive progress of money holdings, together with certificates of deposit (like assured funding certificates (GICs) in Canada) and cash market funds. Money holdings within the fourth quarter of 2023 elevated by $270 billion to $18 trillion. Regardless of that comparatively small enhance, the rise in worth of U.S. equities has led to American households to carry extra of their wealth in equities than at any level in historical past (save the dot-com growth in 2000).

There are seemingly many causes for this shift, however these components may seemingly be probably the most outstanding influences:

- It’s simply basic math, since U.S. shares are on such an extended “successful streak” post-2008, the worth of these property goes to be price extra relative to different property.

- As firms full the shift from defined-benefit pension plans to defined-contribution plans, it’s attainable extra shares are being bought on the particular person stage.

- The common investor obtained smarter due to rather more accessible data. Consequently, they now perceive the long-term wealth-creating potential of proudly owning giant firms (each domestically and internationally).

- Millennials and older Gen Zers are sticking round within the inventory market after being launched to it through the meme-stock and pandemic world of 2021.

- There hasn’t been a brutal bear marketplace for U.S. shares since 2008. Positive, there have been substantial pullbacks at first of the COVID-19 pandemic, after which once more in 2022. However, these have been comparatively short-lived. When the shares did come again, they returned in an enormous method—thus, rewarding buy-and-hold buyers.

A contrarian investor would possibly say this means an oversold market. We’re not so positive that’s the case. Given the long-term monitor document of U.S. shares, we’d be shocked to see inventory allocations fall under 35% of family property within the foreseeable future. That’s as little as it obtained through the worst days of the pandemic. There was a sturdy paradigm shift in how buyers see the inventory market from a danger/reward perspective.

Canadian buyers aren’t doing so dangerous both. We hit a document excessive final quarter for monetary property of $9.74 trillion, and total internet price reached $16.4 trillion. Monetary property (shorthand for shares and bonds) elevated total internet price by about half a trillion bucks, whereas residential actual property was down about $158 billion. Family debt was up 3.4%, however that’s really the slowest rise in debt since 1990, and the debt-to-income ratio really fell barely.

Will new companies spin off extra worth?

When massive companies purchase new firms or dive into new strains of enterprise they usually tout the benefits of integration and synergies. The speculation goes that the asset shall be extra priceless as a cog within the greater machine. Normal Electrical (GE/NYSE) and 3M (MMM/NYSE) are two of the world’s largest industrial firms and it was fascinating to see them transfer in the other way this week.

In distinction to the bigger-is-better principle, firms can typically get too massive and be hindered by layers of paperwork. In that case, the spin-off thought is put ahead, by which part of the corporate shall be separated into its personal entity so it might probably concentrate on offering a narrower services or products. The extra narrowly-focused firm ought to, in principle, excel because it’s not distracted by the tangle of company equipment on the mum or dad firm.

GE accomplished its company restructuring final Wednesday, as the previous mum or dad firm has now been divided into:

- GE Vernova (GEV/NYSE): The vitality property of the outdated GE.

- GE Aerospace (GE/NYSE): The outdated GE market ticker continues on as a pure aerospace firm.

- GE HealthCare (GEHC/NASDAQ): GEHC was efficiently spun off in late 2022, and is up about 57% because it began buying and selling.

GE Aerospace shares completed down 2.42% on their first day of buying and selling, whereas GE Vernova was down 1.42%.

[ad_2]