[ad_1]

These days many Liquid Funds giving us respectable round 7% secure and fewer risky returns. Ought to we spend money on Liquid Funds for Lengthy Time period Targets?

What are Liquid Funds?

Liquid Funds are debt mutual funds the place the fund supervisor has a mandate to spend money on debt and cash market securities with a maturity of as much as 91 days. That is the definition of SEBI.

Nevertheless, this seems to me just like the broad open place for fund managers to spend money on any debt and cash market safety (even low-rated safety). With 91 days interval, one can cut back the rate of interest danger volatility. Nevertheless, if the fund supervisor took the chance and invested in low-rated papers, then there’s all the time a danger of default or downgrade.

Many could also be shocked by my notion. Nevertheless, in case you examine the historical past (Is Liquid Fund Secure And Various To Financial savings Account?), there are situations the place one Liquid Fund crashed by nearly 7% in a single day!!

This incident is a traditional instance and warning to those that BLINDLY consider that Liquid Funds are secure and fewer risky. If the fund supervisor took a BLIND danger, then you need to face the chance.

Why are Liquid Funds now giving 7% implausible returns?

It’s all due to the inflation trajectory through which we’re at present in. Greater inflation led to greater rates of interest. This impacted a fall in bond costs. The influence of that is extra on long-term bonds than the short-term bonds. Simply due to this, the one-year returns present round 7%.

Simply due to this reverse cycle, we are able to’t assume that going ahead sooner or later Liquid Funds will generate 7% returns safely.

Ought to we spend money on Liquid Funds for Lengthy Time period Targets?

As I discussed the rationale for such a implausible efficiency of liquid funds for a yr, assuming the identical for the longer term isn’t price it. As a substitute, allow us to attempt to perceive the likelihood of previous returns by contemplating the assorted rolling returns of a liquid fund. I’m contemplating a liquid fund which is the oldest and in addition of the best AUM. I discovered that SBI Liquid Fund (Direct) is the oldest with the best AUM (Rs. 58,177 Cr).

I’ve taken the final 10 years of NAV historical past. Therefore, we’ve round 3,741 each day knowledge factors.

Allow us to attempt to perceive the volatility for 1-year, 3-year, and 5-year rolling returns.

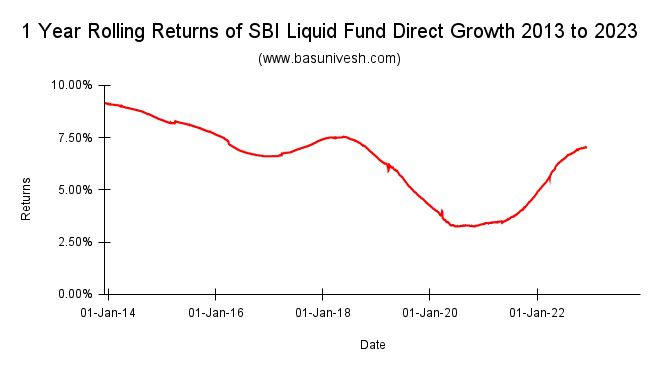

1-12 months Rolling Returns of SBI Liquid Fund Direct-Progress 2013 to 2023

Discover the volatility. The utmost return is 9.16%, the minimal is 3.25% and the common is 6.29%.

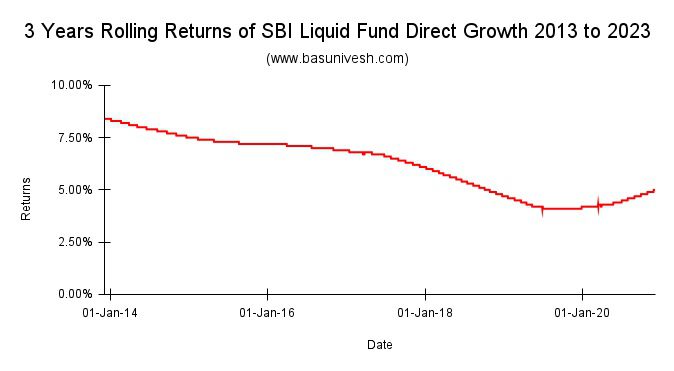

3-12 months Rolling Returns of SBI Liquid Fund Direct-Progress 2013 to 2023

The utmost return is 8.4%, the minimal is 4.1% and the common is 6.12%. The typical returns of 1-year rolling returns and 3-year rolling returns look nearly the identical!!

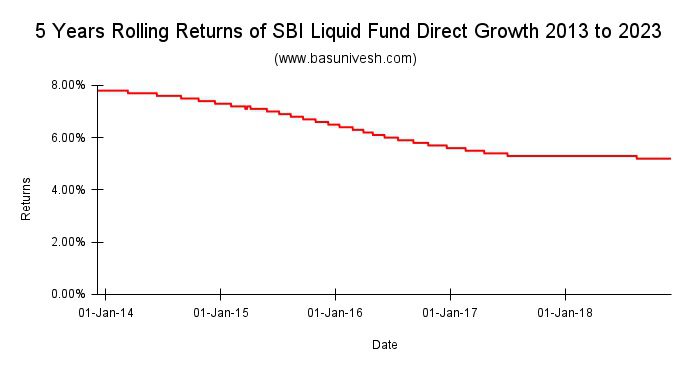

5-12 months Rolling Returns of SBI Liquid Fund Direct-Progress 2013 to 2023

The utmost return is 7.8%, the minimal is 5.2% and the common is 6.28%. The typical returns of 1-year rolling returns, 3-year rolling returns, and 5-year rolling returns look nearly the identical(6.29%, 6.12%, and 6.28%)!!

If the Liquid Funds are SAFE (avoiding default and credit score danger) and fewer risky, then why such a variety of return potentialities even after holding for five years?

The reply is although Liquid Funds could to a sure extent fully keep away from the default or downgrade danger by investing in authorities securities or cash market devices, they’ll’t run away from rate of interest danger.

Therefore, simply due to the upper inflation and better rate of interest cycle, if these funds are producing round 7% returns in a yr doesn’t imply they supply the identical respectable returns sooner or later. For those who look again on the historical past, you discover from the above charts that there have been sure intervals the place the identical Liquid Funds generated implausible returns of over 7.5% for five 5-year holding interval. However on the identical time, we should perceive the explanations behind this and in addition through which curiosity cycle we’re in.

Why one should spend money on Liquid Funds?

Because of the latest tax modifications in Debt Funds (Debt Mutual Funds Taxation From 1st April 2023), there isn’t any nice benefit of PARKING (I’m not utilizing the phrases investing) your cash in Liquid Funds.

Then who can and when one can think about Liquid Funds? One can use the Liquid Funds for his or her short-term objectives like lower than 2-3 years and not sure of precisely after they want the cash. In any other case, a easy Financial institution FD or RD is sufficient to cater to your necessities.

Yet another factor to suppose is although identify of those funds is LIQUID, they aren’t as liquid as your Financial institution FDs (in case you booked by way of web banking). Normally, it takes a day or two to redeem your cash from liquid funds. Instantaneous redemption in Liquid Funds has sure limitations like both Rs.50,000 or 90% of the fund worth (whichever is earlier).

Contemplating all these elements, don’t make investments randomly simply due to the present returns. Fairly than that, you should have a transparent goal in selecting the Liquid Funds. As I’ve given one traditional incident of previous credit score danger historical past, don’t be within the incorrect perception that Liquid Funds are secure. As a substitute, take a look on the portfolio after which take a name.

[ad_2]